New-Home Sales Dip in July as Homebuilders Struggle To Entice Reluctant Buyers

Sales of newly built homes dropped in July, as price cuts and homebuilder incentives failed to lure buyers struggling with affordability.

Signed contracts for new single-family homes were at a seasonally adjusted annual rate of 652,000 last month, down 8.2% from a year earlier, the U.S. Census Bureau and Department of Housing and Urban Development reported on Tuesday.

The July figure was also down 0.6% from June, although that was due to an upward revision to the June data, which grew by 29,000 from the initial estimate to a revised figure of 656,000.

It means that new homes now continue to be priced below existing homes, upending historical trends, with the median price for new homes about $20,000 less than the median sales price for existing homes.

"The median sales price of existing homes and new homes are moving in opposite directions," says Realtor.com® Senior Economist Joel Berner. "Builders have proven more willing to cut prices than home resellers, but this month’s new home sales data suggests that the aggressive pricing is still not enough to get new homes moving at a faster pace."

Home shoppers may be gaining more leverage with sellers in the existing home market, making resale homes more attractive than they have been. Meanwhile, lagging sales of new homes have sent inventory surging.

“Elevated mortgage rates and ongoing economic uncertainty are weighing heavily on buyer demand,” says Buddy Hughes, chairman of the National Association of Home Builders (NAHB). “Meanwhile, an elevated inventory of unsold homes, fueled by lagging sales, is prompting concerns over potential cutbacks in new construction.”

At the end of July, the supply of new houses for sale was at a seasonally adjusted estimate of 499,000—up 7.3% from a year ago but down 0.6% from June following a construction slowdown this year.

It represented 9.2 months of supply at the current sales pace, unchanged from June and up 16.5% from a year earlier.

"Despite more inventory to choose from and price advantages, new home sales continue to lag," says BrightMLS Chief Economist Lisa Sturtevant. "Tariff and immigration policies are making it harder for home builders to deliver more supply, but right now the constraint is on the demand side."

Homebuilders are increasingly offering discounts and other incentives to attract prospective buyers, with the use of incentives hitting a five-year high of 66% this month, according to the NAHB/Wells Fargo Housing Market Index (HMI).

The survey showed that 37% of builders reported cutting prices in August—little changed from 38% in July. The average price reduction was 5% this month, where it has held steady since November.

"Builders are offering more incentives to entice home shoppers, but because the inventory of existing homes has grown and would-be buyers have more options and more negotiating power with sellers, they are less likely to be looking for new construction,” says Sturtevant.

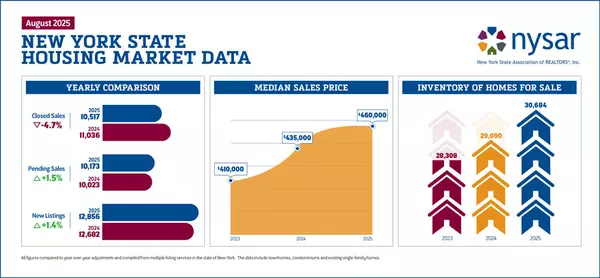

Existing-homes sales, which account for the vast majority of residential real estate transactions, increased 2% last month from June's seasonally adjusted annual rate of 4.01 million, the National Association of Realtors reported last week. The July figure was up 0.8% from a year earlier.

Price growth for existing homes has essentially stalled, with the median sales price in July up just 0.2% from a year earlier. Flat national growth suggests that prices are falling in nearly half the nation.

The national supply of existing homes was at 4.6 months at the current sales pace, up 15% from a year ago and close to a nine-year high.

Still, affordability continues to be a key challenge for buyers of both new and existing homes, with the typical share of income required to make monthly mortgage payments near a 40-year high.

Buyers got some relief this summer from falling mortgage rates, which averaged 6.72% in July, down from 6.82% in June, according to Freddie Mac.

Mortgage rates have continued to fall in anticipation of a potential Fed rate cut next month, with the average 30-year rate matching a 10-month low of 6.58% last week.

"The opportunity for new-home shoppers is ripe, but stubbornly high mortgage rates kept many of them sidelined this July," says Berner. "The recent tick down in rates may spur on an August revival in buyer activity, but the July peak of the homebuying season proved to be muted."

Keith Griffith is a journalist at Realtor.com covering housing policy, real estate news, and trends in the residential market. Previously, his work has appeared in Business Insider, The Street, Chicago Sun-Times, New York Post, and Daily Mail, among other publications. He has a master's degree in economic and business journalism from Columbia University.

Categories

Recent Posts